Nigeria’s New Banknote Crisis – A Case Study in Self-Harm or a Shrewd Step towards Modernising the Economy

On 26 October, 2022, Godwin Emefiele, Governor of the Central Bank of Nigeria (CBN), announced that the bank had redesigned NGN200, NGN500, and NGN1,000 naira notes. It announced that the new designs would replace the old notes over a very compressed timeline in early 2023. The principal reasons for the move were given by the CBN as:

- More than 80% of all banknotes were in public hands – characterised by the CBN as hoarding.

- High rates of, and increasing ease of, counterfeiting of NGN500 and NGN1,000 banknotes

- An excess of bank notes in circulation – having risen from N1.46 trillion in December 2015 to N3.23 trillion in September 2022

- The ambition to fully implement a cashless policy

- To enable security agencies to track anyone who withdraws huge (undefined) sums to determine its use

- The shortage of clean and fit banknotes

- To moderate inflation

- To curtail the activities of kidnappers and bandits by making ransom payments more difficult and to allow tracking of new notes.

Many commentators have, in recent weeks, suggested that the timing of the strategic move is very revealing. It has been suggested that the withdrawal of the old bank notes from legal tender was timed to forestall the payment of huge amounts of cash to influence the outcome of the imminent elections. Some have been more outspoken and claimed it is a direct attack on the APC nominee for the Presidency, Mr Bola Ahmed Tinubu.

President Buhari officially unveiled the new NGN200, NGN500, and NGN1,000 notes on November 23, 2022, at the Presidential Villa in Abuja. On 15 December, 2022, the newly redesigned naira notes were released into circulation as they were dispensed through ATM machines mixed with the old banknotes. However, many commercial banks failed to issue the new notes and seemed to operate an unofficial policy of withholding the new notes until the deadline for the withdrawal of the old notes – 31 January 2023. This had the effect of seeing people deposit the old notes and then being issued with the same old currency. The stage was set for widespread discontent among ordinary Nigerians who were not yet ready to join the cashless society desired by the CBN.

In response, on 04 January 2023, the CBN banned over the counter cash withdrawals in an attempt to ameliorate the effect of a dramatic shortage of the new notes. Compounding the difficulties experienced by millions of Nigerians, the CBN governor ordered commercial banks to set the withdrawal limit of the new notes at NGN100,000 (c.$135) for individuals and NGN500,000 (c.$660) for corporate bodies. Moreover, the maximum cash withdrawal via ATM per day was pegged at NGN20,000 (c.$25) and NGN100,000 (c.$135) per week. This strategy triggered a wave of economic hardship for small businesses, traders, and individuals, leading to an outburst which forced the CBN to increase the limit to NGN500,000 (c.$660) for individuals and NGN5 million (c.$6,600) for corporate accounts.

Early in 2023, the Governor of Kaduna state, Nasir El-Rufai, addressed the economic hardship being inflicted on people as a result of the CBN’s policy on cash withdrawal limits, alleging that “CBN mopped up over NGN2 trillion of the old notes but only printed NGN300 billion of the new notes”.

In response to the growing crisis, the House of Representatives sent an invitation to the CBN governor to address the House and explain the policy and strategy to them. He ignored the invitation until an infuriated Speaker of the House threatened Emefiele with arrest. He then, reluctantly, appeared before them on the day of the deadline for withdrawal of the old notes. During his meeting with lawmakers, Emefiele extended the deadline date to deposit the old naira notes to 17 February, 2023, which also meant holders of the old notes could spend them till 10 February.

It was initially reported that the cash shortage was caused by banking authorities failing to release enough new notes. However, the Economic and Financial Crimes Commission (EFCC), has reported that it has conducted raids in which officers had arrested bank managers for allegedly hoarding the new notes in vaults rather than putting them in ATMs and giving them to customers.

Following a legal challenge initiated by the APC-run northern states of Kaduna, Kogi and Zamfara, on 09 February 2023, the Supreme Court waded into the crisis, suspending the deadline for withdrawal of the old notes. On the same day, the International Monetary Fund and the World Bank both called on the Federal Government to push the deadline for implementation back to alleviate the growing hardship being experienced by Nigerians. On 13 February 2023, Ekiti, Bayelsa, Sokoto and Rivers joined the group of states lodging the legal challenge to the CBN strategy. The Supreme Court heard the case on 15 February but immediately adjourned the case until 22 February amid the expectation of an address to the nation by the President.

On 15 February 2023, President Buhari addressed the nation (a full transcript of the address is available at Annex A). Following the address, he ordered the release of the old format N200 notes back into circulation alongside the new format notes of N200, N500 and N1,000 denominations until 10 April. This step, broadly in line with the recommendations of the IMF and World Bank, is designed to ease the hardship being experienced by millions of Nigerians and has been met with mixed reactions. The move leaves the old format N500 and N1,000 denominations as no longer legal tender. Some commentators stated that the move would save many small businesses from failure. Significant dissatisfaction exists at the continuing scarcity of the new bank notes amid suspicion that the banks are witholding the new format notes.

It is noteworthy that the extension will allow Nigerians to sustain their businesses beyond the presidential elections due on 25 February 2023 and the state and local council elections due to take place on 11 March 2023. It is illuminating that the President stated that “this new monetary policy has also contributed immensely to the minimization of the influence of money in politics”. The aim is admirable, with the timeline being compressed in order to maximise the impact on electoral fraud and vote-buying, but the implementation of the strategy has, to a large extent, been muddled and possibly counterproductive.

The Impact of the Strategy on Social Cohesion

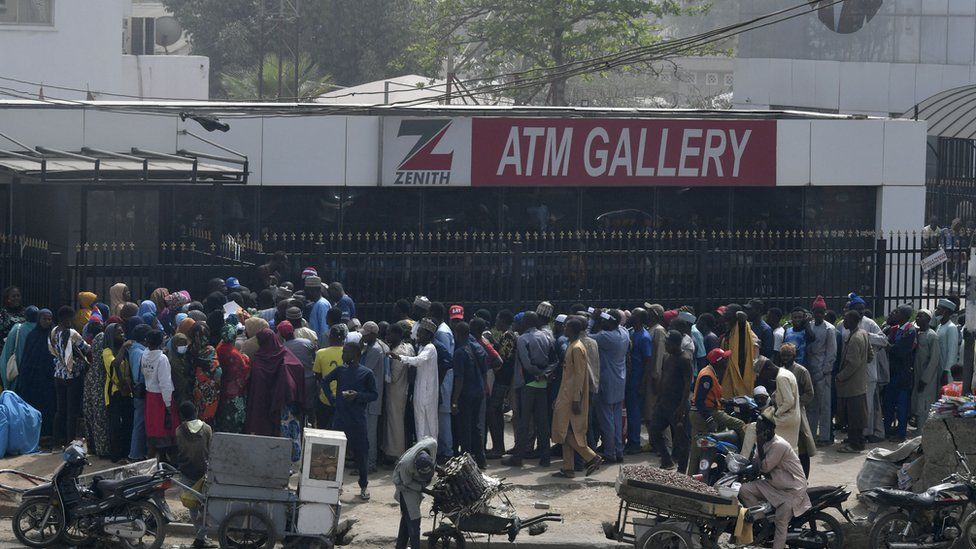

Since early February, banks across the country have been closing their doors to customers due to the scarcity of the new format of bank notes. Particularly affected have been banks in Lagos, Ogun and Abuja. The crisis is affecting multiple banks including Fidelity Bank, First Bank, Zenith Bank, Access Bank and Guaranty Trust Bank.

Small businesses that depend on day-to-day cash transactions have been unable to access their funds or manage their cashflow. Point Of Sale operators are being forced to shut down as they are unable to withdraw cash to service their businesses. This has resulted in a suppression of commerce compounded by the fact that the customers were also unable to access cash to spend in the markets. Worst hit were businesses that handle perishable goods.

Millions of Nigerians do not have bank accounts and in many families the main earners have been struggling to support their families due to their inability to acquire cash. One estimate says that approximately 40% of Nigeria’s adult population does not have a bank account, particularly those living in rural areas. Even for those that have an account, the shortage of new naira notes is leaving many people unable to pay bills and buy sustenance. The CBN policy of moving towards a cashless society is unrealistic as the country currently lacks the infrastructure to facilitate such an ambition.

Businesses that did have POS payment facilities were forced to close and those that stayed open are charging exorbitant interest rates, adding further misery to the already struggling people of Nigeria.

Some banks have been attacked as patrons find the ATM machines unable to dispense the non-existent new currency. Customers are queueing for hours to withdraw the very limited amounts of cash the CBN will permit banks to issue. Anecdotal information tells of people queueing for hours, only to be told they can only have N3,000 due to the shortage of new notes. The banks are in a difficult position, but their customers are suffering extreme hardship. One customer was allowed to withdraw just one thousand naira – and then only because they pleaded that they would not be able to pay for transport to reach home again. Fights have broken out and anyone fortunate enough to be able to withdraw cash risks being robbed by desperate citizens and opportunistic thieves. Amid threats against bank staff, the National Union of Banks, Insurance and Financial Institutions Employees have threatened to withdraw their services of its members nationwide following attacks on some commercial banks.

Inflation has also surged, as those with cash available impose punitive interest rates on ordinary customers. Anecdotal information indicates that money changers are charging N6,000 for a N20,000 transaction. A survey by one Nigerian newspaper revealed that Point of Sale (PoS) transaction charges jumped 400% in most cities across the country in the first week of February.

Some Nigerians have also been unable to purchase essential medications without access to cash. This has impacted to such an extent that the Governor of Borno State ordered the release of N300 million worth of drugs to government hospitals and called on hospitals to issue them free to patients.

Violence and protests have been spreading across the country as a result of the upheaval including;

- Commercial drivers refusing to accept old format notes in Ibadan, Oyo State leading to widespread stranding of commuters generating significant tension;

- Protestors barricading streets with bonfires in Ondo Town, Ondo State and in Sango Ota, Ogun State;

- Protestors setting fire to a branch of Access Bank in Udu Udu LGA, Delta State;

- Protests locking down the Eleko Axis Of Kwara State Polytechnic in Ilorin;

- Security forces being forced to fire warning shots as protestors blockaded the CBN office on the ring road of Benin City, Edo State;

- Protests erupting in Port Harcourt on Ozuoba Road in the Rumuosi area;

- Violent protests taking place in Mokola and Sango in areas of Ibadan in Oyo State.

Political Implications and Fallout

The timing of the transition – within weeks of the Presidential election and months of the State and local council elections – could not have been worse. The move has triggered widespread hardship and discontent among countless millions of Nigerians – most of whom are entitled to vote in the upcoming polls.

The social impact cannot have been overlooked in the planning of the strategy and, indeed, according to some commentators, it was probably considered a desirable outcome. This is reflected in comments by the All Progressive Congress (APC) Presidential candidate, Asiwaju Bola Ahmed Tinubu, who has publicly alleged that the move was designed to damage the APC’s election prospects. Coming at the same time as a fuel shortage and pricing crisis, the bank note change out is generating very high levels of frustration and anger among the population.

Atiku Abubakar of the main opposition PDP backed the policy in principle but said it had been implemented poorly, while Peter Obi of the Labour Party urged Nigerians to be patient, saying the reforms would have long-term benefits.

If Tinubu’s allegations are correct, and the crisis is contrived for political reasons, it would have the potential to light the fuse of an explosive situation. Tinubu has reportedly warned that he would set the country ablaze if he loses the election unfairly. The veracity of that report is unknown, but the political veteran has long been known as a kingmaker, initially in the Peoples’ Democratic Party, and latterly the All Progressive Congress. It is widely accepted that his wealth and influence is sufficient to shape the political landscape of the country, and that may be the basis for the report.

The political position of the CBN Governor is itself fueling speculation that the strategy is politically inspired. Emefiele was appointed to the position in 2014 after the previous Governor, Sanusi Lamido Sanusi was ousted after illuminating the issue of missing revenues. Emefiele has been Governor since then and exposed his political ambitions when in 2022 he sought to run as the APC presidential candidate. The Supreme Court ruled against his candidacy, and this has led to speculation that the unhelpful timing of the currency exchange might be simply a case of settling political scores.

Interestingly, if Tinubu is correct, and the instability triggered by the CBN strategy reflects back onto the APC at the polls, the Presidency will most likely go to a northern candidate, breaking the long-standing so-called Zoning Arrangement irreparably. Such an outcome will have dangerous political implications and could lead to widespread social unrest as the south rejects the result. Following the 2011 elections, thousands of Nigerians died in sectarian and political violence when the north felt it had been robbed of the Presidency. It is very likely that the south will feel equally cheated, resulting in a wave of political violence across the mid-belt states and targeting some communities in the southern states.

What to Expect

The Supreme Court decision has bought the government some time, but the outcome is not going to change; the bank notes will be changed. However, how quickly they will be introduced remains to be seen. Some analysts suggest it will take another 3-6 months – which is beyond the elections and into the first term of the new Presidency.

Meanwhile, the average Nigerian will continue to suffer great hardship caused by the shortage of hard currency. This will undoubtedly lead to more frequent outbreaks of unrest at banks as well as an elevated level of risk posed by destitute people being forced into street crime in order to sustain their families. Other negative effects include;

- Pedestrians leaving banks are likely to be more frequently targeted by the desperate of the opportunists;

- Motorists sitting in traffic, already at risk from marauding gangs of armed robbers will become even more heavily targeted;

- Small businesses – especially those that handle cash such as beer parlours, street vendors, hair salons etc or that trade in consumables (rice, cooking oil etc) – will be more likely to suffer theft and robbery.

- The predatory gangs that have existed for years will become even more energetic in their activities and could pose an elevated threat to individuals and small businesses.

In the event that the APC loses the Presidential election, there is a significant risk of widespread political violence in protest at the perceived ‘rigging’ of the election by the CBN.

There is also a heightened risk of sectarian violence in mixed communities and along sectarian fault lines in some areas including, but not limited to, Kaduna, Benue, Plateau, Kano City and parts of Lagos.

To try and assist their customers, some banks have waived fees for transferring money, others opened on Saturday and Sunday. However, other banks have been forced to close due to the threat of violence to their premises and staff. Arete will continue to monitor notices/advice from the banks and other institutions, along with the ongoing situation, and provide updates accordingly.